There are many people who would prefer pay later payment opportunities. So, do you want to enhance your business by offering such a convenient option to your customers? You are at the right place. This article will show you how to enable buy now, pay later payments in WordPress using different plugins.

Why Offer Buy Now, Pay Later Payments Plan?

Buy now, pay later payments (BNPL) is a type of short-term financing that offers customers to buy items from your website and pay for them in future installments.

It is a powerful tool for increasing sales and boosting your conversions. Additionally, it improves the checkout experience for a large number of customers. With BNPL, you can still sell to people who might need help paying the total price in one go. BNPL can also raise the average order value by making customers purchase more than they can pay upfront.

Even though the customer has time to pay off the balance, you still get paid in full at the time of purchase. The BNPL provider takes on the risk of getting paid back and helps protect against fraud in some ways. So, you don’t have to worry about missing or being late on payments, which could happen with traditional payment plans.

However, unlike regular credit cards, using BNPL damages customers’ credit scores. Since BNPL is intended to be a short-term financing solution, only a few suppliers offer interest-free payments.

Here are more benefits of offering buy now, pay later payments in WordPress.

Benefits of Buy Now, Pay Later Payments

- Multiple payment choices: Customers with different payment options feel more in control and appreciate your efforts to make transactions simple for them.

- Reduces fraud risks: Using a reputable BNPL provider to manage the installment payments for your WooCommerce business can lower your risk of payment fraud.

- Conversion rates and sales: BNPL makes it easier for people to buy things since they are more likely to buy something if they can pay for it in installments instead of all at once.

- More money: BNPL is a solution that benefits both you and your clients. Customers get what they want without lump-sum payments, and you can charge extra for items with monthly payment choices.

Your client could hesitate to spend $700 on a course but would be willing to pay that same amount in 10 installments of $79 per month instead. People spend more money with BNPL because they pay the higher price over an extended period rather than the big one-time cost. - Marketing exposure to your business: BNPL companies keep lists of all the merchants they work with. So, if you work with a BNPL provider, your store will appear in their shopping directory. This will speed up your marketing and make it easier for you to get new customers.

All in all, BNPL is the perfect solution for your WooCommerce store if you sell expensive or high-value items.

How to Choose a Buy Now, Pay Later Payments Provider?

You have to choose the right buy now, pay later providers based on the products you sell, their prices, and your consumer base. Consider the following while selecting providers.

Credit limits

Every customer has a different spending limit based on how much they use the service, how much credit they have, and how well they have paid back loans. However, some buy now, pay later services have minimum and maximum credit limits. Again, determine your average order size and choose a provider that gives customers enough credit to make a purchase.

Repayment terms

Buy now, pay later providers offer different payment plans and terms, which can last anywhere from a few weeks to several years.

So, if your business’s average order value is usually high, you should look for providers that let your customers pay over a more extended period (like monthly installments over twelve months).

On the other hand, companies with a lower average order value might be able to provide fewer installments over a shorter period, such as four installments over six weeks.

Customer location

Consider the geography of your target market to determine where you should introduce a pay later payment option. You should pick the most well-liked local provider of BNPL payments services. If you want to cover the most ground possible, you may need to provide more than one later payment option.

So, let’s look at the best BNPL plugins that will ensure customers are satisfied, so you get more sales and make more money.

Buy Now, Pay Later Plugins for WordPress

We will discuss three different plugins to enable buy now, pay later payments in WordPress. These include:

- WP Simple Pay

- WPForms

- Easy Digital Downloads

Let’s have a look at each of them one by one.

1) WP Simple Pay

WP Simple Pay is one of the best plugins to enable buy now, pay later payments in WordPress. You can create payment forms with WP Simple Pay without setting up a complicated checkout process or a full shopping cart.

Using this plugin, you can create simple payment forms without dealing with complicated payment APIs(Application Programming Interface). There are many ways to customize your payment forms, such as using a drag-and-drop editor or simply using Stripe’s checkout payment pages.

With WP Simple Pay, it is straightforward to customize your forms so you can have them up in minutes.

Here are some features of WP Simple Pay.

Features

- Coupon codes integration.

- Add Apple Pay and Google Pay buttons.

- Customers get recurring payments with several subscription plans.

- Pre-built payment form templates.

- Allow custom amount payments.

- Well-integrated with Elementor and Divi

- Accept ACH and alternative payment methods

Pricing

WP Simple Pay is a premium plugin that starts at $99/year with a 14-day money-back guarantee.

2) WPForms

WPForms is another flexible and easy-to-use builder plugin to enable the buy now, pay later payments in WordPress. As the most powerful form builder plugin available, it provides you with many choices and features when it comes to designing your payment forms.

This plugin includes add-ons that make this plugin an excellent choice for a payment plugin. Moreover, WPForms is compatible with online payment systems such as Stripe, PayPal, Authorize.net, and Square.

If you compare WPForms to other plugins, you will notice that WPForms offers a Stripe integration process that is more streamlined than other plugins.

Here are some features of WPForms.

Features

- Multiple templates like online order forms to sell physical services and goods, digital downloads, or collect donations.

- Easy to use with a drag-and-drop visual builder.

- Allows Stripe recurring payments.

- Create high-converting forms, such as landing pages, conversational contact forms, surveys, and many more.

- Combine different fields with payment.

- Allow multiple payment types using smart conditional logic-based user answers.

Pricing

WPForms is a premium plugin that starts at $99/year with a 14-day money-back guarantee.

3) Easy Digital Downloads

Easy Digital Downloads (EDD) is another fantastic plugin that allows you to integrate buy now, pay later payments in WordPress. It is an excellent plugin enabling you to sell digital goods with Stripe, like software, ebooks, and many more.

EDD is pre-packaged with all the features you will ever require to sell digital downloads. These features include the ability to restrict file downloads by time and attempt and a fully functional shopping cart. In addition to Stripe, the best thing about EDD is it allows you to accept payments via Apple Pay, Google Pay, PayPal, Authorize.net, and many more.

Additionally, it enables you to integrate your site with other popular services, such as Dropbox, and email marketing services, such as Mailchimp, Amazon S3, and many others.

Here are some salient features of EDD.

Features

- Accept recurring payments for selling digital downloads.

- Sell license keys for your digital products and software.

- Advanced order and customer management within WordPress.

- With detailed reporting, you can gain actionable insights into your business.

- EDD allows for Stripe subscriptions.

- Allows you to pre-approve payments and charges at a later date.

- Supports many currencies and exchange rates.

Pricing

EDD comes in both free and premium versions. The Premium version starts at $199/year with a 14-day money-back guarantee.

How to Enable Buy Now, Pay Later Payments in WordPress

Enabling pay later payments is a simple and straightforward job. So, if you want to offer buy now, pay later payments in WordPress, just follow the following steps, and you will be good to go.

Step I: Install and activate the plugin

- Login to the WordPress dashboard.

- Navigate to Plugins > Add New

- Search for the WP Simple Pay plugin in the search box.

- Once you have found the plugin, click on the Install button to install the plugin.

- After installation, click on Activate, and it will activate the plugin on your WordPress site.

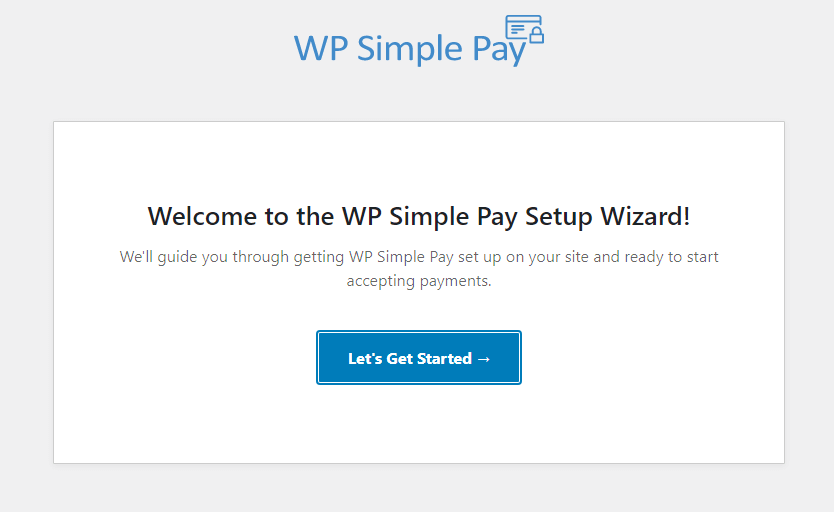

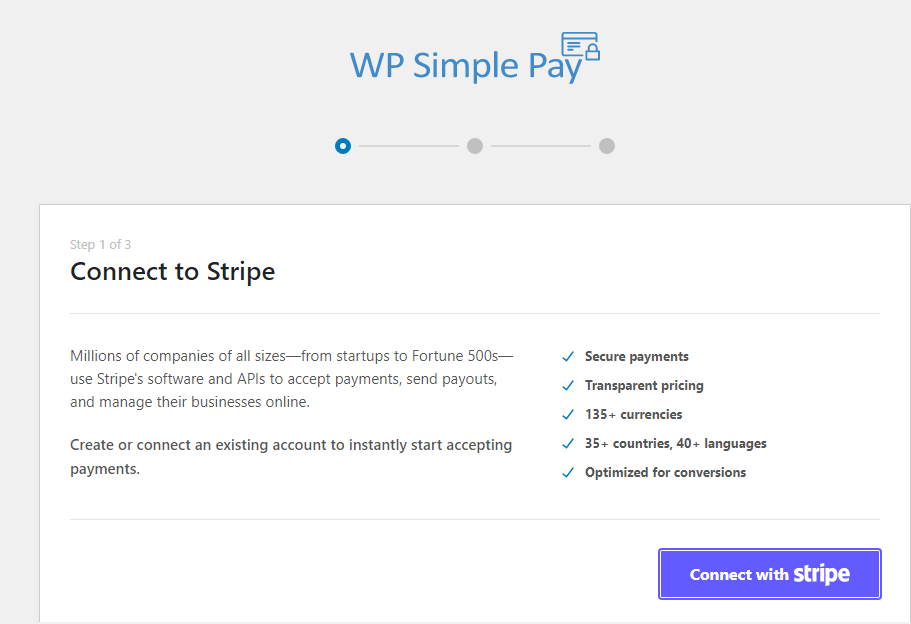

After installing and activating the plugin, you will be directed to the setup wizard. With the help of the setup wizard, it’s easy to make a Stripe account and link it to your website. Click Let’s Get Started to start.

If you didn’t see the setup wizard, go to WP Simple Pay > Settings, click on the Stripe tab, and then click the Connect with Stripe button. You can link your Stripe account to your site by clicking on it.

Now you need to connect WordPress to Stripe to start receiving pay later payments in WordPress. Let’s get to it.

Step II: Connect WordPress to Stripe

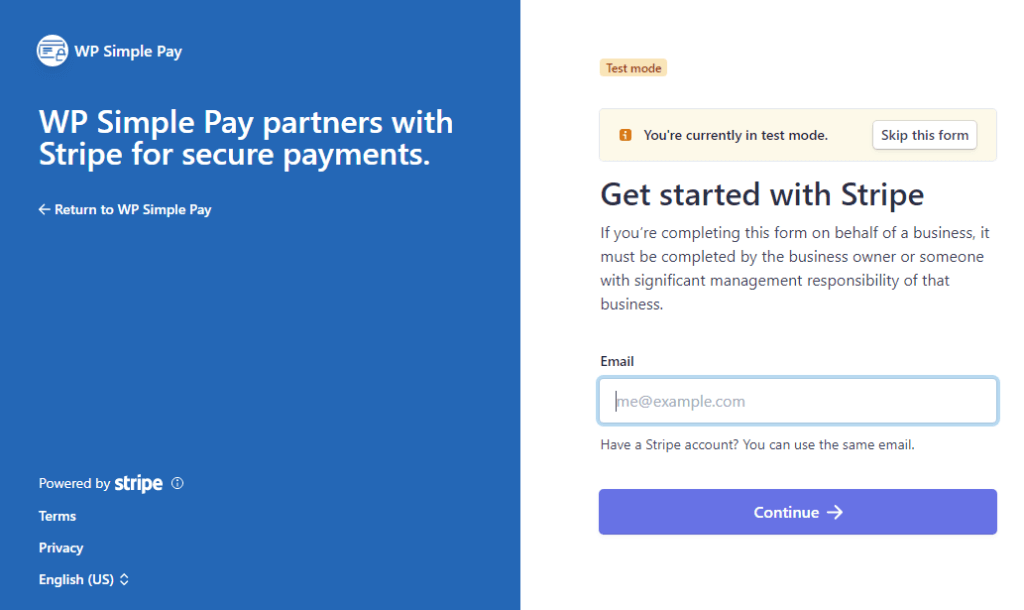

Once you click on Let’s Get Started, you will be directed to set up a new Stripe account or connect an existing account to WordPress. Click on Connect With Stripe.

Please don’t skip this form because it will create a temporary Stripe account that can’t be recovered or switched to Live Mode. Instead, enter your email address and start making an account. If you have an account already, it’s easy to link it to your site.

You need to create a buy now and pay later form when you are done. Let’s learn how to do that.

Step III: Create a buy now, pay later form

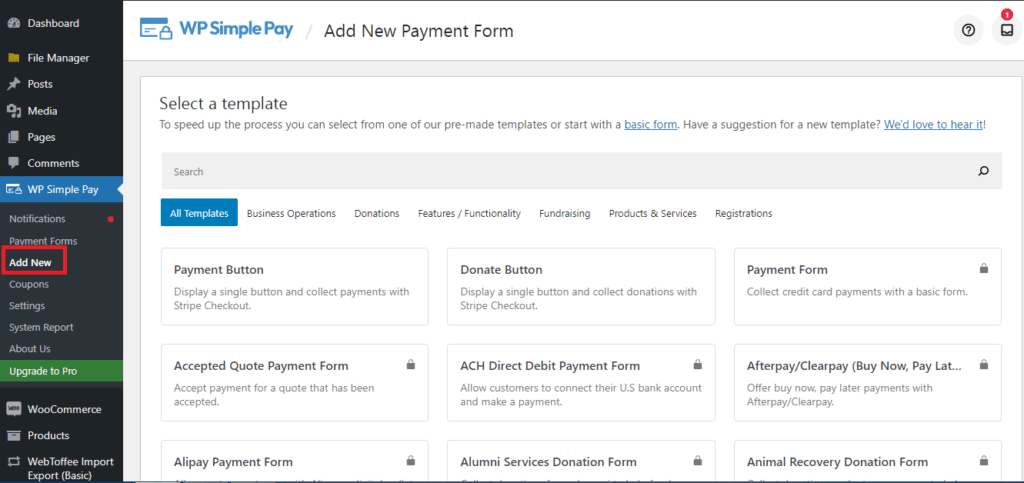

Go to WP Simple Pay > Add New.

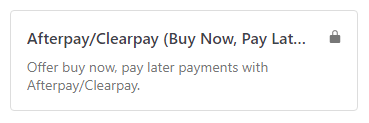

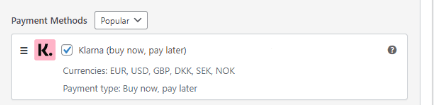

Now you will have a variety of form templates for accepting payments on your website. WP Simple Pay accepts two different Buy Now Pay Later services: Afterpay/Clearpay and Klarna.

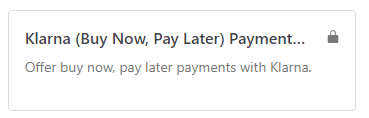

Klarna is currently available in the following countries: Belgium, Denmark, France, Germany, Denmark, Estonia, Finland, Ireland, Italy, Lithuania, Netherlands, Latvia, Netherlands, Norway, Spain, Sweden, Slovakia, Slovenia, the United Kingdom, and the United States.

Whereas, Afterpay/Clearpay is available to Stripe users in the following countries: Australia, Canada, Italy, New Zealand, France, Ireland, Italy, the United Kingdom, and the United States.

The best part is that you can set up a payment form that works with Klarna or Afterpay/Clearpay in minutes using WP Simple Pay. To begin, there is no application, onboarding, or underwriting process.

Select the Klarna (Buy Now, Pay Later) Form template to create a payment form with Klarna. Select Afterpay/Clearpay (Buy Now, Pay Later) Form otherwise.

The configurations are similar for both Klarna and Afterpay. But you have to buy a paid version of the plugin to use these templates.

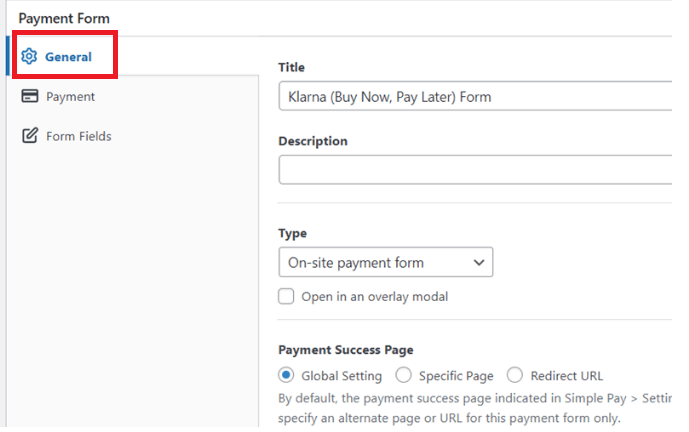

You can configure your form and change the description of your form via the general setting. By default, the type On-site payment form is set. However, you can also change it to an off-site payment form.

Likewise, you can customize your payment success page with WP Simple Pay. You can choose between a Specific Page from your site or a Redirect URL to redirect users to an external site.

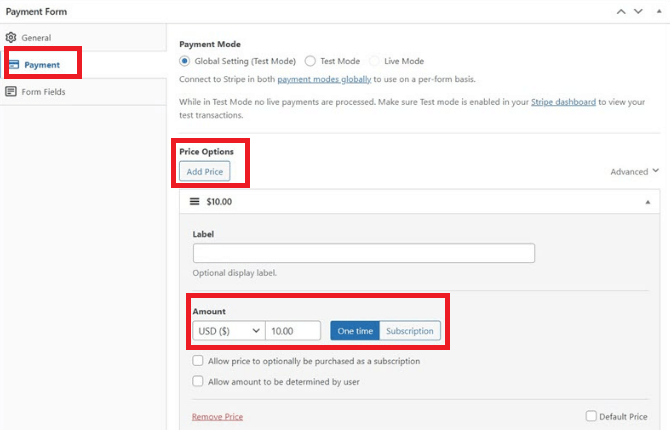

To see the default price, click on the payment option on the right side. You can edit payment mode, price options, and amount here as per your need.

Now, if you click on payment options, you’ll be able to customize the amount and currency. Also, you can give the option to choose between subscription payment and one-time.

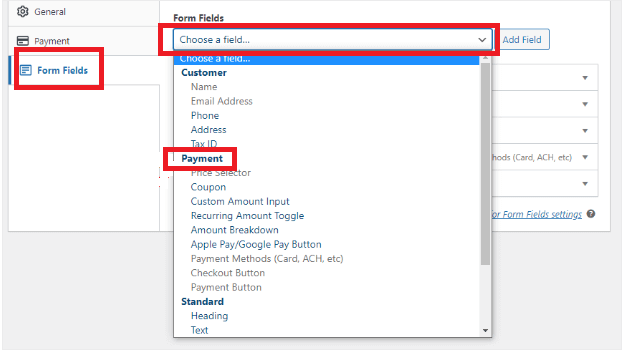

Here, you can add different fields by clicking on Add Field button.

You can find payment options below the field options. Since we chose the Klarna form template in the previous step, you should now select the Klarna payment option here.

You can preview the payment form before saving the form as a draft. You can publicize the payment form if the form doesn’t need any further changes.

Step IV: Publish Your Buy Now, Pay Later Form

Now that your payment forms are ready, you need to add them to your website and make them public.

Always make sure to test the form before making it public. You can switch between test and live mode for your site or each payment form.

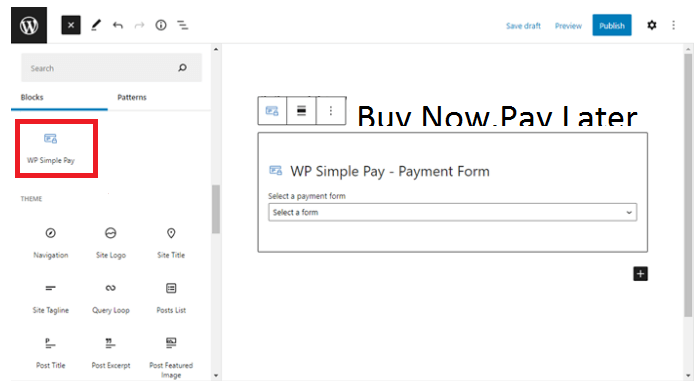

To embed the form, navigate to the post or page on which you wish to publish it. Then, click the plus sign (+) to add the WP Simple Pay block.

Select the form you created and click on Publish. That’s it. Your payment is now live and available for the users to interact and make purchases.

Conclusion

Adding a pay later payments option can help people who can’t pay full price at once, to still go on and make the purchase. Customers are also more like to purchase more items than they can pay up-front for. Thus BNPL payments help improve your conversions, boost your sales, and improve your customer’s experience.

In this article, we discussed the buy now, pay later payments in WordPress and how they can benefit your online business. We also had a look at the three top BNPL plugins, so you can pick the one best suited to your requirements. Afterward, we learned how to add buy now, pay later payments in WordPress using the WP Simple Pay plugin with the Klarna payment method.

We hope you have found this article helpful. If so, we have many other guides on our blog that you would find useful. Here are a few related posts that you might also be interested in: