Best WooCommerce Tax Exempt Plugins

Are you looking for tax-exempt tools for your eCommerce store? You’ve come to the right place. In this article, we will have a look at some of the best WooCommerce tax-exempt plugins.

Having the tax exemption option is quite common in most eCommerce websites. It usually depends on the location of the customers and their tax numbers. There are several ways to enable tax exemption on your store, but if you’re looking for an effective and easy method, plugins are the way to go.

Before we analyze some of the best tools you can use for this, let’s better understand why using a tax exemption plugin can be a good idea.

Why Use Tax Exempt Plugins?

WooCommerce tax-exempt plugins are developed to help your customers avoid paying certain taxes in your online store. There might be several reasons why a customer might be approved for tax exemption such as location, tax condition, and so on. Whatever the reason might be, a tax-exemption plugin will help you and your customers make the process smoother.

For example, some tax-exempt tools have dedicated tax removal features for specific reasons such as locations, user disabilities, and so on. Furthermore, some of these plugins even provide manual or automatic tax exemption if needed.

Additionally, if you don’t have much programming knowledge and want to make changes to your WooCommerce store, plugins are your best choice. And since the tax-exempt tools provide both you and your shoppers with a lot of help for the exemption options, they can be quite useful.

Best WooCommerce Tax Exempt Plugins

The best tax exemption plugins for WooCommerce are:

- Tax-Exempt for WooCommerce (Premium)

- WooCommerce Tax-Exception (Premium)

- Tax-Exempt by Woosuite (Premium)

- WooCommerce Tax Exempt (Premium)

- Disability Tax Exemption (Premium)

- WooCommerce EU VAT & B2B (Free and Premium)

Let’s have a closer look at what each of these tools has to offer.

1) Tax Exempt for WooCommerce

Tax-Exempt for WooCommerce is one of the most popular tax exemption plugins. It lets you easily tax-exempt your customers and user roles based on different conditions. And since it is available on the official WooCommerce website, it is fully compatible with most WordPress plugins.

This tool also has features to display tax exemption forms on the WooCommerce My Account page. Similarly, you can also customize the fields of the tax exemption form, grant tax exemptions from the backend, set up notifications and messages when someone submits the tax-exemption form, and much more.

Key Features

- Allow merchants to tax-exempt all or selected customers and user roles

- Display tax exemption form on WooCommerce My Account page

- Customize form fields for tax exemption form

- Email notification for tax exemption submissions and requests

- Tax exemption status displayed to the customers

Price

Tax-Exempt for WooCommerce is a premium plugin that starts at 59 USD and includes a 30-day money-back guarantee and 1 year of support and updates.

2) WooCommerce Tax Exemption

WooCommerce Tax Exemption is another premium tax-exempt plugin that you can use to remove taxes for your customers. It comes with notification options for both customers and admins for tax approval and requests respectively and allows you to manually accept or reject the requests.

The plugin provides a customizable form for tax-exempt requests and allows you to add custom fields and files with a drag and drop feature. This can be very convenient for your customers to easily upload the necessary information for tax-exempt requests.

Key Features

- Drag and drop file upload field for tax-exempt request form

- Notifications for customers even for tax-exempt request rejection

- Manually approve and reject tax-exempt requests

- Redirect guest users to request tax-exempt

Price

This is a premium plugin that’s available in Code Canyon for 29 USD and includes 6 months of updates and support.

3) WooCommerce Tax Exempt by Woosuite

If you want a versatile plugin to create advanced conditional tax-exempt rules, WooCommerce Tax Exempt by Woosuite is for you. This tool allows you to add tax-exempt rules for your B2B customers using coupon codes as well as based on the user roles. You can also add conditions to these rules depending on the product, category, user roles, and country of the buyers.

Similarly, WooCommerce Tax Exempt lets you control how you display the pricing to your customers throughout the site. You can provide prices including or excluding taxes according to user roles, override the price suffix, add tax number and certificate options, and even use automatic tax exemption for verified users.

Key Features

- Tax exemption triggered by coupon code

- Conditional tax-exempt for selected customers, user roles, products, categories, countries, and more

- Display prices with inclusion or exclusion of taxes based on user roles

- Configure price displays on archive and product pages

- Customize form fields for tax exemption form

Price

WooCommerce Tax Exempt by Woosuite is a premium plugin that starts at 6.50 USD per month. It includes a 14-day money-back guarantee and 1 year of support and updates.

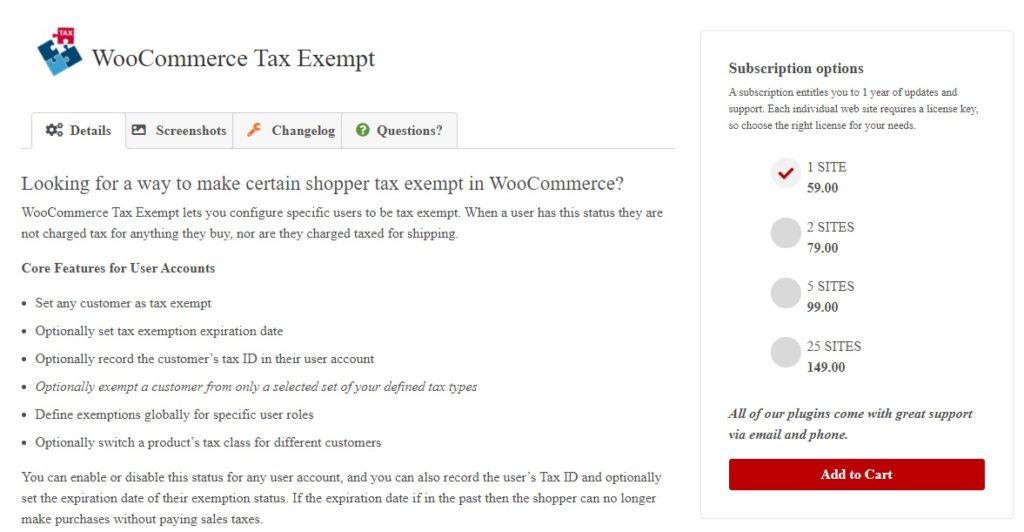

4) WooCommerce Tax Exempt

As the name suggests, WooCommerce Tax Exempt is a plugin that allows you to set customers as tax-exempt and shoppers to remove taxes on the checkout page. It also lets you add a tax-exempt expiration date and even exempt customers from specific taxes.

Moreover, you can also record the tax ID in their user account and let them set their defined tax types. Finally, you can also switch the product’s tax class for different customers.

Key Features

- Tax exemption expiration date

- Record the customer’s tax ID in their user accounts

- Switch the product’s tax class for different customers

- Define exemptions globally for specific user roles

- Exempt a customer from only a selected set of defined tax types

Price

WooCommerce Tax Exempt is a premium plugin that will set you back 59 USD and includes 1 year of updates and support.

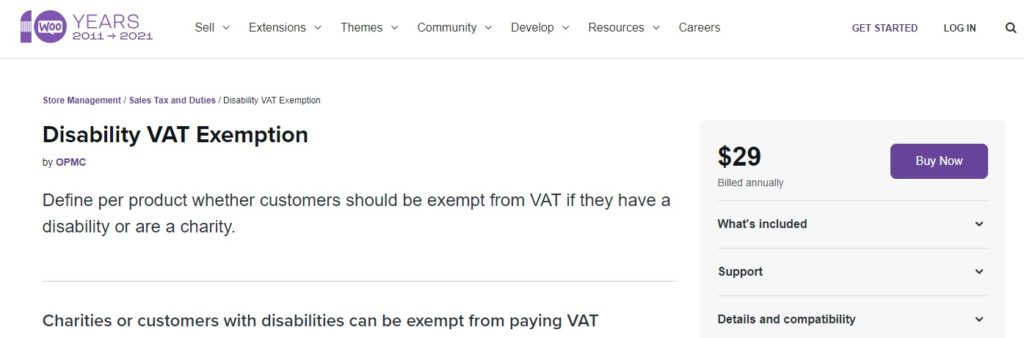

5) Disability VAT Exemption

Disability VAT Exemption is another one of the best WooCommerce tax-exempt plugins. It’s available on the official WooCommerce website and allows you to remove the VAT during the checkout process for your customers with disabilities or charity organizations.

The plugin uses a simple checkout form that allows shoppers to enter the details for exemption. These details are attached to the order and allow them to avoid having to pay VAT. Finally, you can also set exemptions for certain products so they have no VAT.

Key Features

- VAT and tax exemption for customers with disabilities

- VAT exemption form in checkout for disability VAT exemption

- Charity VAT exemption form for registered charities

- Full compatibility with WooCommerce and most WordPress plugins

Price

Disability VAT Exemption costs 29 USD per year and comes with a 30-day money-back guarantee.

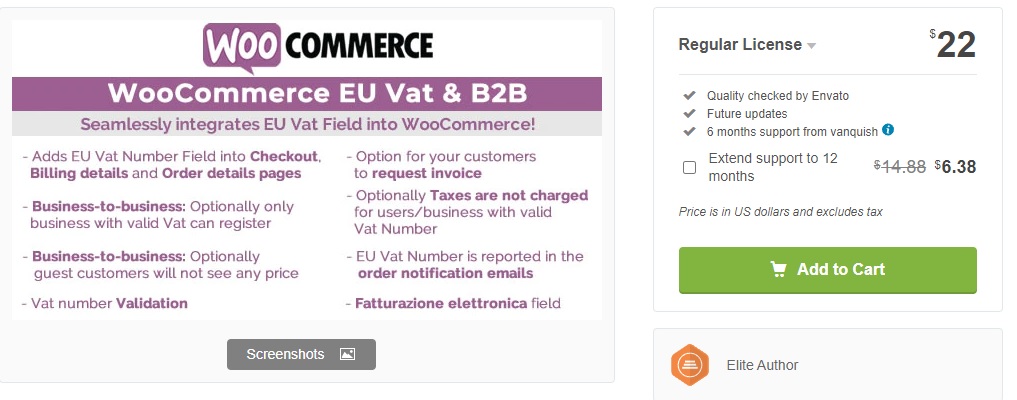

6) WooCommerce EU VAT & B2B

WooCommerce EU VAT & B2B is a plugin to add an EU VAT number field on your WooCommerce store that includes tax-exempt features to exempt VAT for users with specific tax numbers.

Additionally, you can tax-exempt customers with the same billing addresses as the shop base location, and remove VAT for a customer if they enter a valid EU VAT number. This tool is designed mainly for businesses and supports WPML multilanguage.

Key Features

- Tax exemption for customers with valid VAT numbers

- Option to remove tax for customers with same billing addresses as shop base location

- Additional customization options for tax removal

- WPML multilingual plugin support

Price

This is a premium plugin that starts at 22 USD and includes 6 months of support and updates.

Bonus: Set up WooCommerce Tax Exempt with a Plugin

So far, we’ve listed some of the best WooCommerce tax-exempt plugins. Now as a bonus, let’s have a look at how to set them up so you can start using them in your store.

For this demonstration, we will use Tax Exempt for WooCommerce. It is easy to use and comes with tons of helpful documentation.

Before we start, make sure that you have properly set up WooCommerce and you’re using a compatible theme. If you aren’t sure which theme to use, have a look at one of our collections on the best WooCommerce themes.

Since Tax Exempt for WooCommerce is a premium plugin, you need to subscribe to one of its plans and download the plugin zip file.

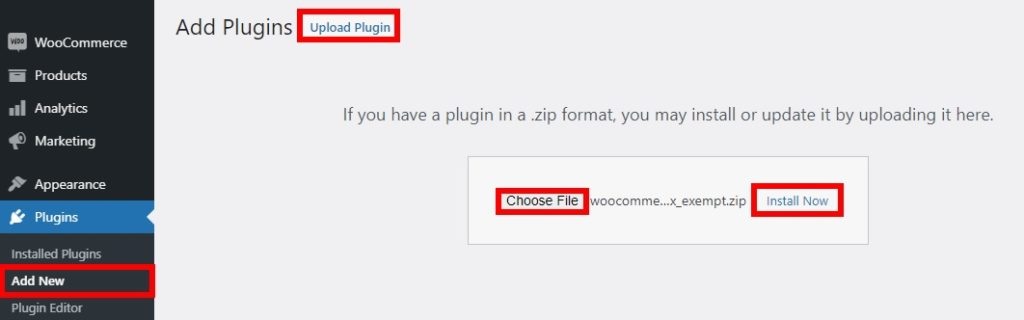

1. Install and Activate the Plugin

To start using the plugin, you need to install and activate it first. In your admin dashboard, go to Plugins > Add New and click Upload Plugin. Then press Select File to upload the plugin zip file that you have previously downloaded. After that, click Install Now.

After the installation is complete, Activate the plugin. If you need any help regarding the installation process, have a look at our detailed guide to install a WordPress plugin manually.

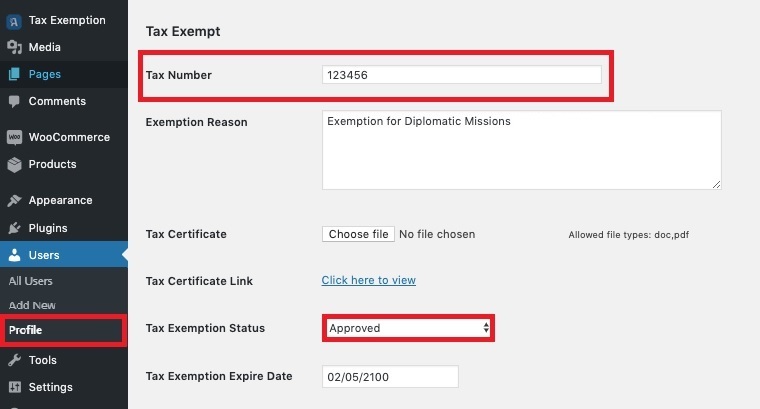

2. Set Tax Numbers for Tax Exemption as Admin

Your customers will now need to fill up a form to request tax exemption. They can do that from the Tax Exemption tab on the WooCommerce My Account page. As an admin, you need to add the tax numbers that can be approved for tax exemption.

For that, all you need to do is go to Users > Profile and scroll to the Tax Exempt section.

There, fill in the tax number and set the tax exemption status to Approved. You can also add more details for tax exemption such as exemption reason, tax certificate, and tax expiration date if needed. Once this is done, update the profile.

From now on, if the entered tax number entered by the user is the same as the one that you have set in their profile, the tax exemption will be approved for that user.

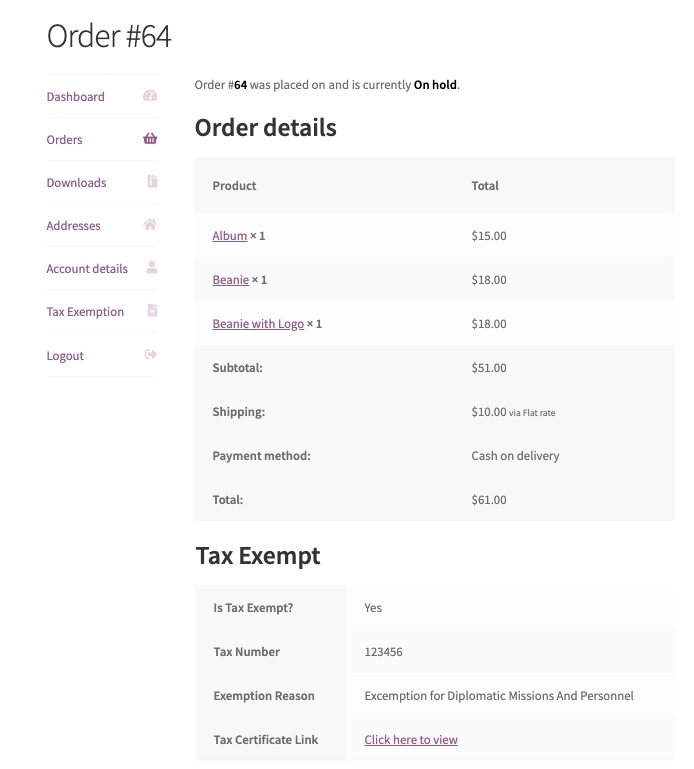

The details for the exemption will then be displayed under the Orders tab in the WooCommerce My Account page as shown below.

You can also configure the tax exemption options for the guest users using this plugin.

Using a dedicated tool is the easiest way to add a tax exemption feature to your site. However, it’s not the only way. If you have coding skills and don’t want to spend money on plugins, you can include tax exemptions programmatically. For more details on how to do this, check out our full guide on WooCommerce tax exemption.

Conclusion

All in all, using a plugin is the easiest way to allow your customers for tax exemption on your website. In this guide, we’ve had a look at some of the best tax-exempt plugins for WooCommerce that will do the job in a few clicks.

All of them are paid plugins and include useful features to help you and your customers with tax exemption needs. But which one is the most appropriate for you? That depends on the type of business you have and your needs.

Tax-Exempt for WooCommerce is one of the best plugins if you want a simple tool for tax exemption. On the other hand, if you have specific reasons to allow tax exemption like user disabilities, a tool like Disability VAT Exemption can also work very well for you. Finally, if you want to allow tax exemption depending on fixed locations like EU countries and want some more business advantages, WooCommerce EU VAT & B2B is your best choice.

If you want to know more about tax exemptions on how to apply them with a bit of coding, have a look at our complete WooCommerce tax exemption guide.

We hope that this post was helpful for you. If you enjoyed the read, please share it with your friends on social media.

Have you used any of these plugins? Do you know of any other tools we should include? Let us know in the comments section below!